If you are building a menstrual or fertility app, read this before you launch

A data-backed look at how the top menstrual health apps attract millions of organic visitors, and the visibility strategy Femtech founders can use to grow sustainably.

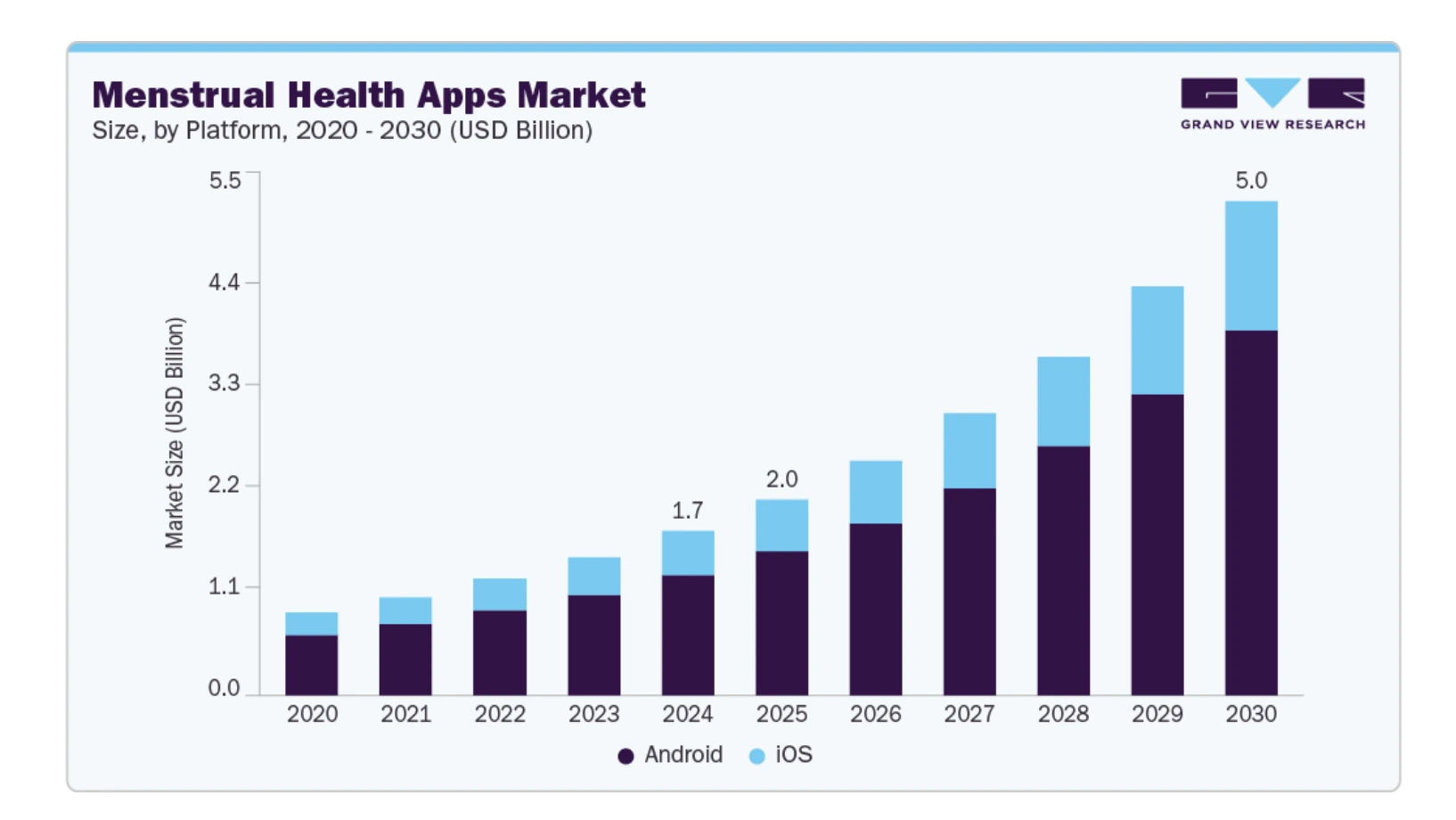

The menstrual and fertility app market is growing fast, expected to reach USD 5B by 2030 according to this study. It’s exciting, competitive, and full of opportunities for founders who genuinely want to bring something valuable to women’s health.

Whether you’re building a cycle-tracking app, a hormone insights tool, a fertility companion, or a symptom-analysis platform, visibility is everything.

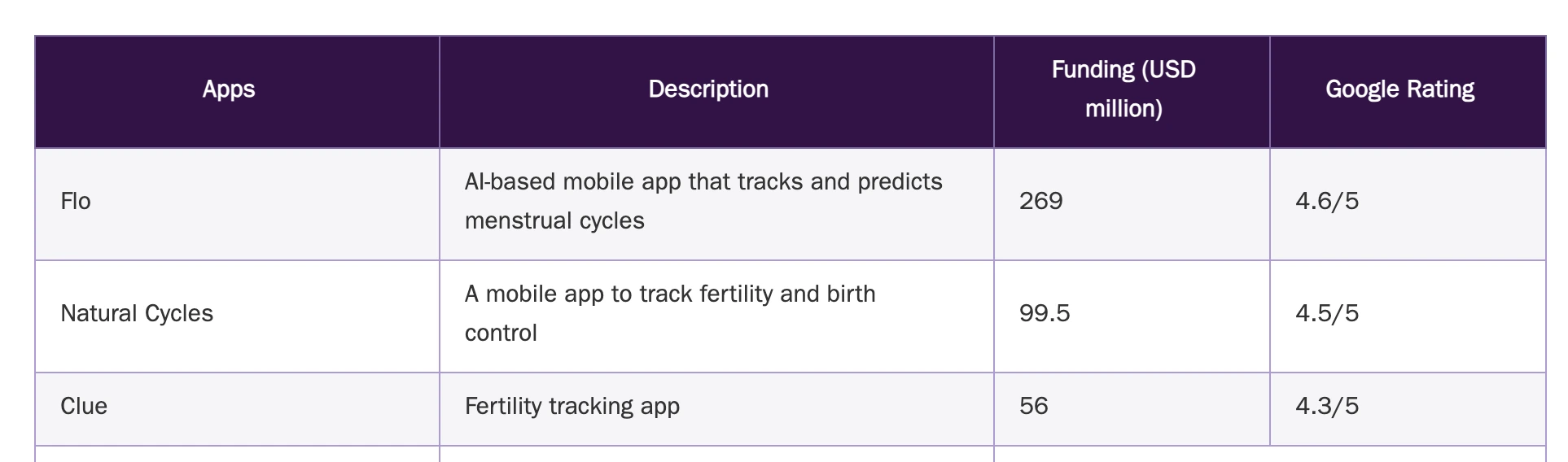

Now that you’ve seen that Flo, Natural Cycles and Clue lead the menstrual-health app space, the next question is:

How visible are these apps today, and what does that mean for your own growth?

To answer this, I analyzed the organic visibility of Flo, Natural Cycles, and Clue using industry-standard SEO tools (Ahrefs). These tools estimate search traffic, keyword rankings, and traffic value, allowing us to understand how each brand attracts users before they ever download the app.

It’s important to note that these numbers are estimates, not internal analytics. But they give direction and are widely used across the industry to benchmark competitors. And for our purpose – understanding market dynamics and identifying opportunities – they’re more than enough.

With this in mind, let’s look at how each app performs in search, which parts of their websites drive the most visibility, and what strategic lessons you can apply to your own Femtech product.

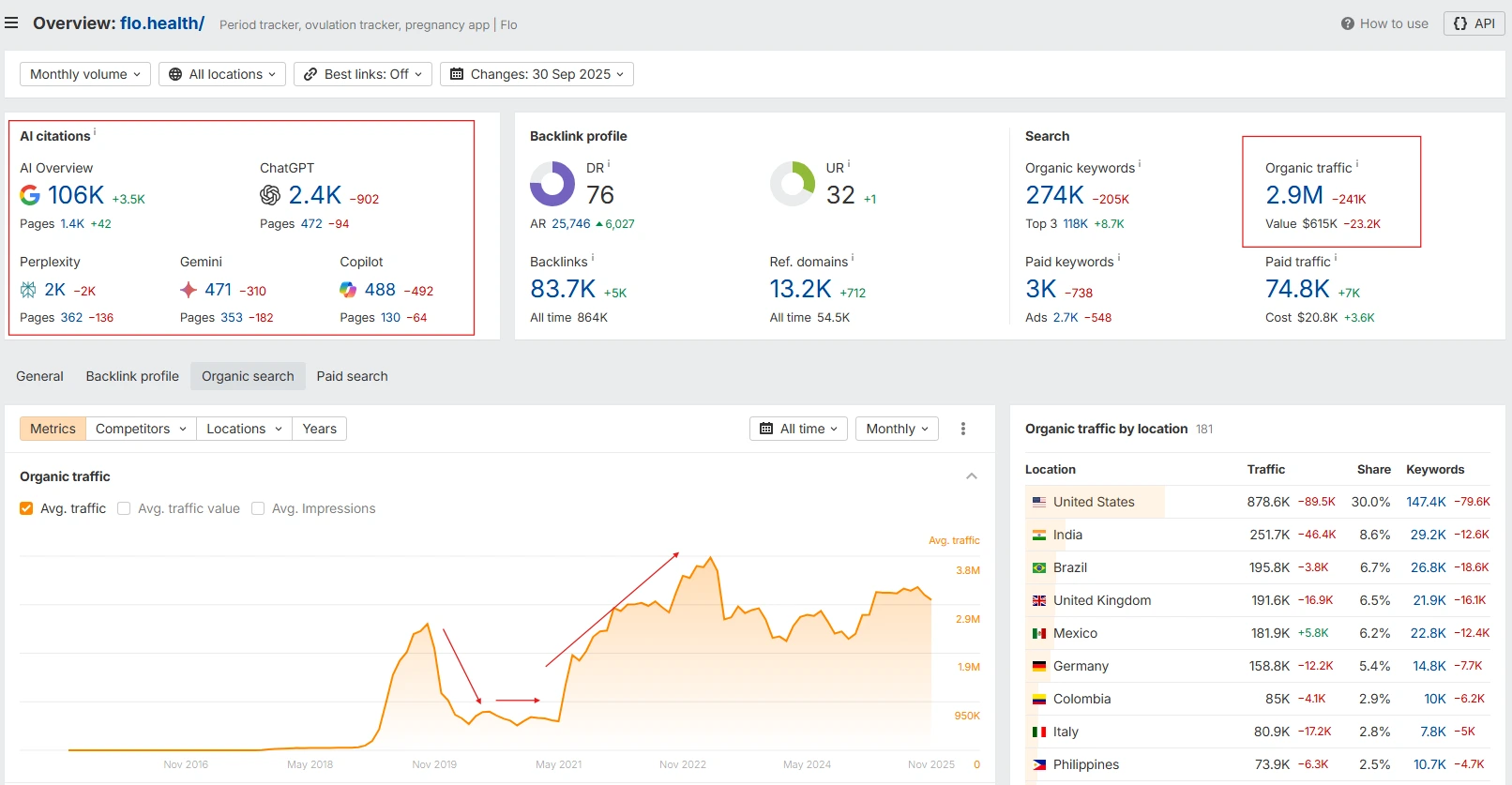

Flo: the content strategy behind 2.9M monthly visitors

Exceptional Organic Reach

Flo attracts 2.9M monthly organic visitors, making it one of the strongest visibility engines in the femtech market. Their content aligns extremely well with what women search for online.

Temporary Visibility Drop (2019–2021)

Flo experienced a noticeable decline in organic traffic during this period. Drops like this can happen for many reasons: site changes, content restructuring, technical issues, increased competition, or major industry shifts.

Strong Across Search & AI Tools

Flo ranks consistently across both traditional search and AI-powered search results. This shows their topics match user intent deeply, they answer real questions women ask.

Successful visibility recovery

What matters is Flo’s recovery. They rebuilt their organic performance by strengthening their content architecture, improving structure, and refining the topics they cover, which is exactly what we’ll break down next.

SEO snapshot: why Flo’s content model works

In the mysterious SEO world, if more than 30 – 40% of your pages drive traffic, you’re doing well. Flo is at 73%, which is exceptional.

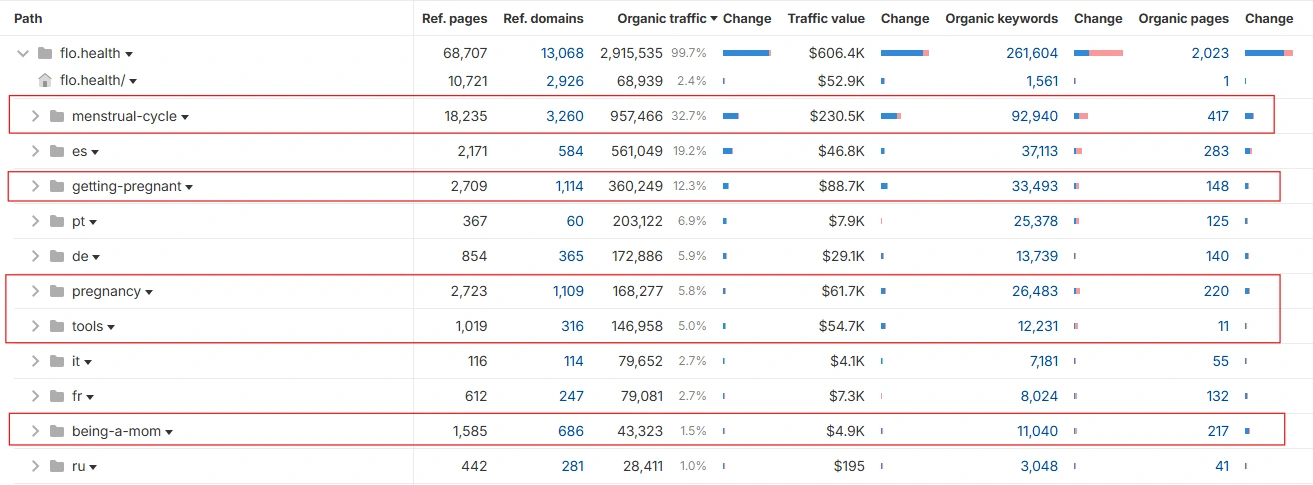

Flo’s content architecture: the real engine behind their growth

When you look at Flo’s site structure, a clear pattern appears. Instead of publishing content randomly, they’ve built strategic clusters around the key phases of the reproductive journey: menstrual cycle, getting pregnant, pregnancy, being a mom, tools (calculators).

These clusters are not just categories, they act as acquisition engines. Together, they account for more than 50% of all pages receiving organic traffic, and over 60% of Flo’s entire traffic value.

This structure is powerful for three reasons:

- Women search by life stage (cycle → trying to conceive → pregnancy → postpartum).

- Content is internally linked, making it easier for Google (and AI tools) to understand the relationships.

- Each cluster helps women answer specific questions, which builds trust long before a user downloads the app.

The table below shows how much traffic value each cluster generates. Traffic value is an SEO metric that estimates how much you would need to spend in ads to get the same traffic. It gives us a sense of how valuable each part of the website is.

|

Cluster

|

Traffic value

|

Number of organic pages

|

Value of each page

|

|---|---|---|---|

|

Menstrual cycle

|

$230.5K

|

417

|

$552

|

|

Getting pregnant

|

$88.7K

|

148

|

$599

|

|

Pregnancy

|

$61.7K

|

220

|

$280

|

|

Tools

|

$54.7K

|

11

|

$4,973

|

|

Being a mom

|

$4.9K

|

217

|

$22

|

Menstrual cycle, Getting pregnant, Pregnancy are the strongest clusters

Tools is the cluster with the highest value per page thanks to high-intent searches

Being a mom is a smaller cluster but strong for postpartum retention

Key learnings: what should you take from Flo’s strategy

Content efficiency

Flo’s content engine is exceptionally strong. Their pages consistently attract meaningful traffic because they focus on topics women actually search for.

- 73% of all indexed pages drive organic traffic.

- 613 visitors per page on average (rare in health).

- Strong alignment with real search intent.

Localization as a growth lever

International versions of Flo’s site significantly boost visibility. Localization brings a large share of their traffic and should be a priority for Femtech brands.

- US = 30% of total traffic.

- All locales combined = 38% of visibility.

- Early localization enhances long-term growth.

Smart content architecture

Flo builds around the reproductive journey women actually follow. This structure helps users and helps Google/LLMs understand the site.

- Strong UX that mirrors real-life questions.

- High topical authority from well-built clusters.

- Tools capture high-intent users.

Want quick insights about your own site?

If you’re curious about where your app stands today – visibility, content gaps, opportunities – I can take a quick look and share the biggest wins you can act on immediately.

How Natural Cycles uses “Cycle Matters” to drive 76% of its visibility

Natural Cycles attracts around 1.1 million organic visitors every month, which is impressive for a brand positioned primarily around fertility awareness and hormone-free contraception.

If you look at their visibility graph, you’ll notice a steady growth pattern, especially from 2022 onwards, showing that their content strategy has matured significantly over the last few years.

Overall, Natural Cycles has built a stable and focused visibility engine that performs consistently well in a competitive space. Let’s break down what drives their traffic.

SEO snapshot: why Natural cycles' content model works

Natural cycles' content architecture

Their entire organic visibility is driven by one major content pillar, Cycle Matters.

The Cycle Matters hub accounts for:

- 76% of all organic traffic.

- An estimated traffic value of $155K.

- An average value of $446 per page.

This tells us that Natural Cycles relies heavily on educational content to attract users. Their product pages are not the main entry points, women find the brand through questions, symptoms, and cycle-related concerns.

Key learnings: what should you take from Natural cycles' strategy

The “Cycle Matters” mega-hub

A single folder powering 76% of their traffic. It’s not one topic, it’s a fully structured hub with multiple sub-categories.

- Many interconnected topics under one URL = strong topic authority.

- Great internal linking and depth boost overall visibility.

- This is why one hub drives the majority of traffic.

High-intent pages drive verything

1.1M visits with only ~20% of pages performing. Most of the site doesn’t contribute, but that means opportunity.

- 80% of pages bring little to no traffic.

- Massive room for optimization (updates, merging, pruning).

- A few optimized pages = big visibility lift.

US dependency & localization gaps

Their traffic is concentrated in the US (47%). International growth is underdeveloped, unlike Flo.

- Non-US locales generate only ~19% of traffic.

- Localization is the fastest untapped lever (which reduces risk of over-dependency on US competition.

- German, French, Portuguese = immediate opportunities

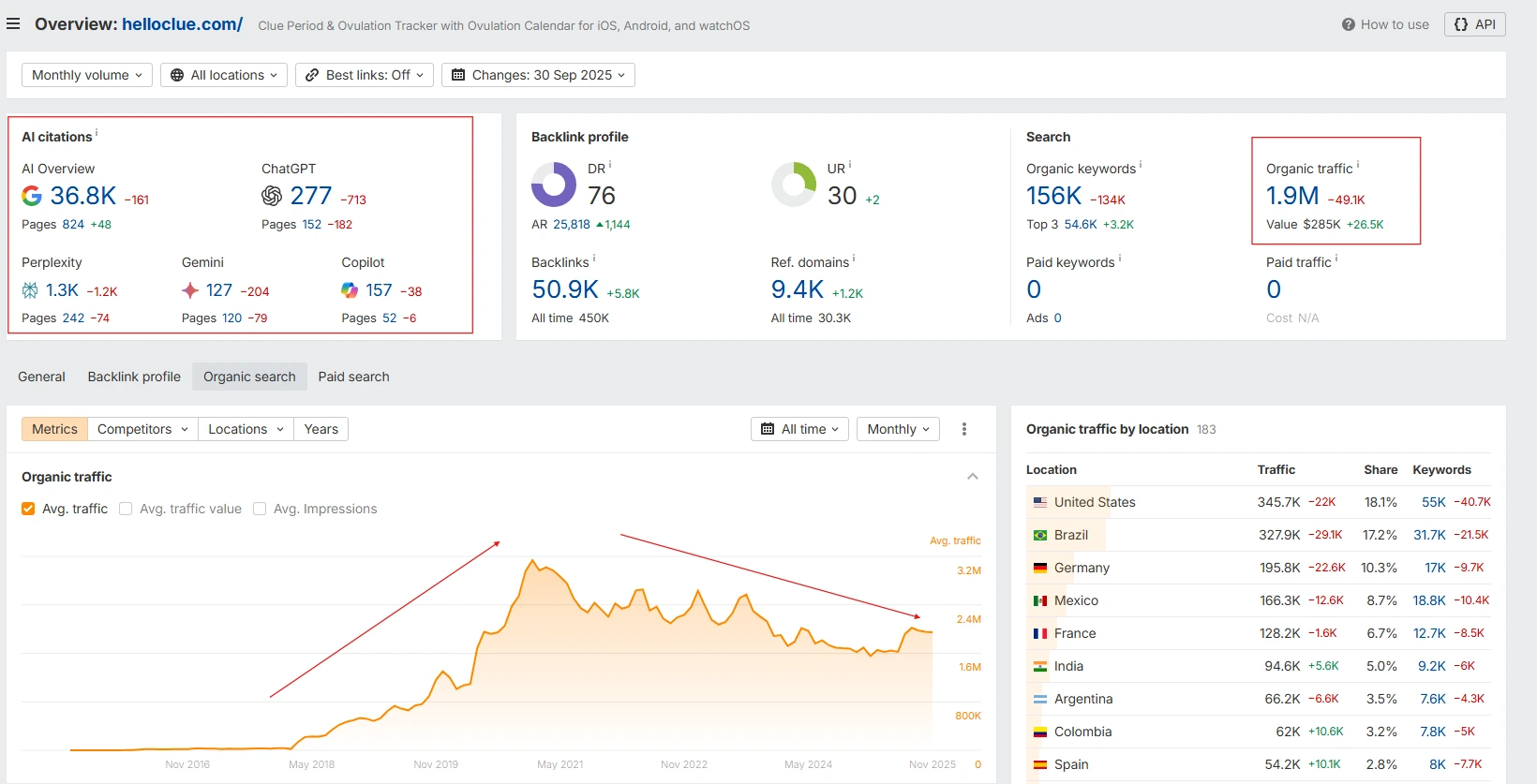

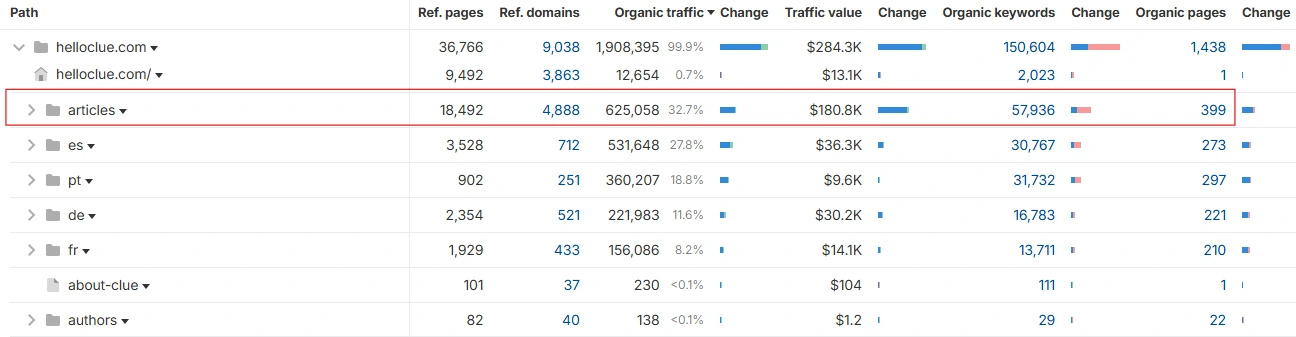

SEO snapshot: why Clue's content model works

Clue's content architecture

Clue’s site also relies on one main content pillar: Articles, which accounts for 33% of all organic traffic. This is their version of an educational mega-hub, containing a wide range of sub-categories. The Articles hub is strong, but the rest of their visibility comes from localization, not their primary English site.

Key learnings: what should you take from Clue's strategy

Global visibility strength

Clue wins globally, not locally. Their reach comes from multilingual traffic, not just the US.

- US = only 18% of total traffic.

- All other locales combined = ~67%.

- Spanish & Portuguese are major contributors.

“Articles” hub as the core engine

One main educational hub drives 33% of visibility. Powerful, but less dominant than Flo or Natural Cycles.

- Centralized content under “Articles”.

- Covers a broad range of cycle- and health-related topics.

- Strong internal linking potential.

Large library, low efficiency

Clue has the biggest content library, but only 27% of pages perform. Huge optimization opportunity without creating new content.

- 9,570 indexed pages but only 27% drive organic traffic.

- Many pages could be refreshed, merged, or redirected.

- Fixing existing content could unlock major gains.

Want quick insights about your own site?

If you’re curious about where your app stands today – visibility, content gaps, opportunities – I can take a quick look and share the biggest wins you can act on immediately.

Where does each brand stand?

To help you understand where each brand stands, here’s a simple comparison of what each app does well, and where they leave room for improvement.

|

Brand

|

Key strengths

|

Key Weaknesses

|

|---|---|---|

|

Flo

|

- Biggest traffic (2.9M/month) - Very efficient content (73% pages work) - High-value pages (category “Tools”)

|

- localization strategy could be improved

|

|

Natural Cycles

|

- Strong high-intent cluster (Cycle Matters driving 76% of organic traffic) - Efficient growth with fewer pages

|

- 80% of pages underperform - Very US-dependent - Weak localization

|

|

Clue

|

- Global reach - Big library

|

- Low content efficiency (only 27% of the pages drive traffic) - Weaker hub dominance

|

Key Takeaways

The strategic patterns shared by all top femtech apps, and what they mean for your product.

Want quick insights about your site and what’s holding it back?

I can take a quick look and highlight your biggest visibility opportunities.

Enjoyed this analysis? Share on LinkedIn and help more femtech founders discover these insights.